More About Financial Education

Table of ContentsAn Unbiased View of Financial EducationGetting My Financial Education To WorkThe Main Principles Of Financial Education The Greatest Guide To Financial EducationThe smart Trick of Financial Education That Nobody is Talking AboutAn Unbiased View of Financial EducationFacts About Financial Education RevealedFinancial Education Things To Know Before You Get ThisAll about Financial Education

Financial literacy is very important because it furnishes us with the expertise and also skills we need to handle money effectively. Without it, our financial choices as well as the actions we takeor do not takelack a strong foundation for success. Best Nursing Paper Writing Service. And this can have alarming repercussions: Provided the above data, it may not be unusual that nearly two-thirds of Americans can not pass a fundamental test of economic literacy.Together, the populaces they offer span a wide range of ages, incomes, and histories. These instructors witness first-hand the influence that economic literacyor the lack of economic literacycan have on an individual's life. We positioned the exact same question to every of them: "Why is financial literacy important?" Right here's what they had to state.

The Best Guide To Financial Education

Our group is happy to be developing a new paradigm within higher education and learning by bringing the subject of cash out of the darkness. We have actually come to be nationwide leaders in our area by validating that individual financial education services are no more an exception for today's studentsthey are an expectation.", Director, Trainee Money Administration Center at the University of North Texas "I believe at an early age, or perhaps in the future in lifeif they've made bad decisions however discover exactly how they can go back and fix them and also begin intending for the future.", Supervisor of Financial Education And Learning, Virginia Lending Institution "Funds inherentlywhether or otherwise it's unbelievably short-term in just acquiring lunch for that day or long-term conserving for retirementhelp you complete whatever your goals are.

Each year considering that the TIAA Institute-GFLEC survey began, the ordinary percentage of questions addressed correctly has increasedfrom 49% in 2017 to 52% in 2020. While there's more job to be done to inform customers about their funds, Americans are moving in the ideal direction.

Some Ideas on Financial Education You Need To Know

Do not allow the anxiety of delving into the monetary world, or a sense that you're "just bad with money," avoid you from enhancing your economic knowledge. There are small steps you can take, as well as sources that can aid you along the road. To begin, take advantage of totally free tools that might already be offered to you.

A number of financial institutions as well as Experian additionally supply totally free debt rating monitoring. You can use these tools to get an initial grasp of where your money is going as well as where you stand with your debt. Locate out whether the firm you function for deals cost-free economic therapy or a worker monetary health care.

Things about Financial Education

With a great or outstanding credit report score, you can receive lower interest prices on finances and charge card, credit scores cards with eye-catching as well as money-saving rewards, as well as a variety of offers for economic products, which provides you the opportunity to choose the ideal deal. However to improve credit score, you need to recognize what factors add to your rating. Best Nursing Paper Writing Service.

The last two years have actually been noted by the events originated from the COVID-19 pandemic. Such events are forming a. This brand-new circumstance is resulting in higher unpredictability in the economic atmosphere, in the financial markets as well as, obviously, in our own lives. Nor need to we neglect that the crisis resulting from the pandemic has actually examined the of representatives and families in the.

The Best Strategy To Use For Financial Education

As we pointed out earlier, the pandemic has additionally raised making use of digital channels by citizens that this website have not always been electronically and also economically empowered. On top of that, there are additionally sections of the population that are much less acquainted with technological advancements and are therefore at. Including to this issue, in the wake of the pandemic we have actually likewise seen the reduction of physical branches, particularly in backwoods.

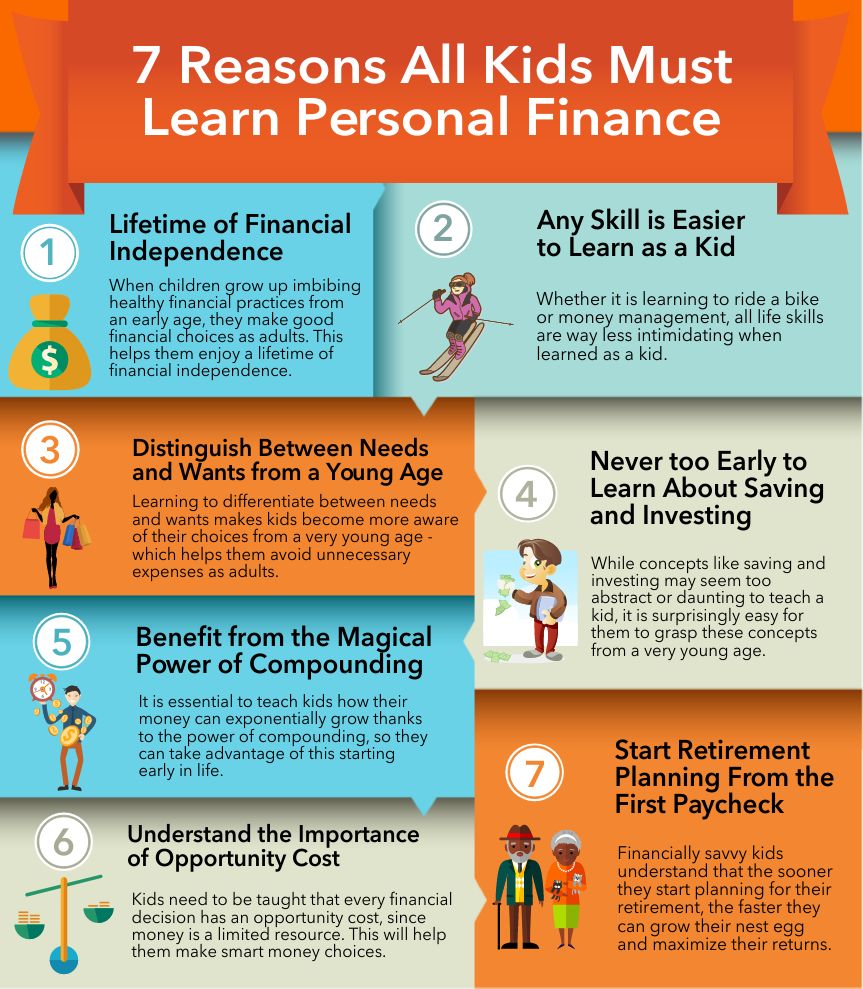

Among the best gifts that you, as a parent, can offer your children is the cash talk. And much like keeping that other talk, tweens and teenagers aren't always responsive to what moms and dads have to saywhether it's concerning authorization or compound passion. As teens come to be much more independent and also believe about life after high institution, it's simply as essential for them to find out regarding economic literacy as it is to do their very own washing.

Getting My Financial Education To Work

Knowing exactly how to make audio cash choices currently will certainly help give teens the confidence to make much better choices tomorrow. Financial proficiency can be specified as "the capacity to use knowledge and skills to handle monetary sources successfully for a life time of economic health." Basically: It's recognizing exactly how to conserve, expand, and also shield your cash.

As well as like any type of skill, the earlier you find out, the even more mastery you'll get. There's no far better location to speak about practical cash skills than in the house, so kids can ask questionsand make mistakesin a secure area. Nevertheless, nobody is much more interested in children' monetary futures than their parents.

Financial Education Fundamentals Explained

While teenagers are taught aspects of monetary literacy at institution, they might additionally soak up wrong information from good friends, peers, or various other grownups in their lives with inadequate money-management abilities. As grownups, we understand the distinction in between what we require (food, an area to live, clothing) and what we want (supersize lattes, a tropical vacation, the most up to date phone).

By instructing youngsters regarding money, you'll assist them discover exactly how to balance wants and needs without entering into debt. Older teens might wish to take place a journey with good friends, however with also a little monetary literacy, they'll recognize that this is a "desire" they may require to budget plan as well as save for.

Top Guidelines Of Financial Education

Does the idea of your teenager hitting the shopping center or buying online this website with a charge card in their name fill you with dread? Speaking about credit rating is essential in aiding tweens and also teens understand the importance of cash and also the effects of making bad monetary decisions. If your teenager requests for a credit scores card, rather than giving an automated "no," assist them comprehend that it's not totally free cash.

Facts About Financial Education Uncovered